Category: Premium Stocks

Protected: Premium Stocks : 11-Jan-26

Protected: Premium Stocks : 26-Oct-25

Protected: Premium Stocks : 9-Aug-25

Protected: Premium Stocks : 6-Jul-25

Protected: Premium Stocks : 26-Apr-25

Protected: Premium Stocks : 9-Feb-25

Protected: Premium Stocks : 25-Dec-24

Protected: Premium Stocks : 16-Oct-24

Protected: Premium Stocks : 15-Jun-24

Protected: Premium Stocks : 3-Mar-24

Protected: Premium Stocks : 13-Jan-24

Protected: Premium Stocks : 26-Nov-23

Protected: Premium Stocks : 20-Oct-23

Protected: Premium Stocks : 28-Aug-23

Protected: Premium Stocks : 1-Jul-23

Protected: Premium Stocks : 27-May-23

Protected: Premium Stocks : 8-Apr-23

Protected: Premium Stocks : 4-Feb-23

Protected: Premium Stocks : 1-Jan-23

Protected: Premium Stocks : 27-Nov-22

Protected: Premium Stocks : 2-Oct-22

Protected: Premium Stocks : 20-Aug-22

Protected: Premium Stocks : 10-Jul-22

Protected: Premium Stocks : 1-May-22

Protected: Premium Stocks : 3-apr-22

Protected: Premium Stocks : 20-Feb-2022

Protected: Premium Stocks : 30-Jan-2022

Protected: Premium Stocks : 16-Jan-2022

Small Insight into Infra Company

Likhitha Infra (approx 33 yr old company) is an Oil Gas Pipeline Infrastructure provider in India. Operations include Cross Country pipelines and associated facilities, City Gas Distribution including CNG stations, and Operation & Maintenance of CNG/PNG services.

Strong presence in more than 16 states and 2 Union Territories in India.

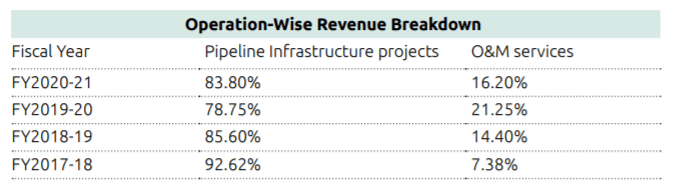

Two major domains, if we divide the operations , are Pipeline Infrastructure Projects and O&M services (Operation and Maintenance)

Revenue breakdown for the domains are highlighted below (for last 4 Financial years)

Strengths

Long standing relationships with domestic marquee customers.

Efficient business model

Strong project execution capabilities

Diversified geographical presence in India

Strong Technical Qualification to bid for new projects

Strong promoter holding showing skin in game

Good ROCE, stable and improving PAT margins and EBITDA

Highly experienced Management Team

Triggers for company in coming quarters

CGD is increasing in India and company is at right place for its business to grow with Strong client base and on top of that company has Strong Technical Qualification to bid for new projects which is visible in orders won recently

Company has received orders worth Rs. 250 Crores (approx.) excluding GST from various City Gas Distribution Companies during the

quarter from October 2021 to December 2021.

Till Aug. 2021 company has an outstanding order book of 1020 cr giving good revenue visibility. In Oct-Dec 2021 , company received 250cr of additional orders

As per the recent Government policies, PNGRB has increased the number of Geographical Areas (GAs) to 228 comprising of 402 districts spread over 27 States and Union Territories, covering 70% of Indian population and 53% of its area. These recent Government initiatives have provided lucrative opportunities for Oil & Gas infrastructure service providers

Recent policy moves, including a wide-scale rollout of CNG and the expansion of gas infrastructure including LNG terminals, long-distance transmission pipelines and city gas distribution networks, will help drive 30bnm³ of gas demand growth over the next decade through fuel switching away from coal and oil. A recent switch to CNG from coal in India’s brick industry is encouraging greater gas use.

Exit Triggers

Order chain drying up in coming quarters

Unforeseeable change in Government policies

Declining margins and increasing debtors or working capital cycle days

Risks

Any change in CGD policy

Much faster penetration of EV in coming 2-3 years

Rising raw material and commodity costs

The Company is deriving significant portion of orders from major Oil & Gas distribution companies inducing a client concentration risk

Insight into Vishnu Chemicals

Vishnu Chemicals Limited is a market leader in manufacturing and sales of Chromium chemicals and Barium compounds across the world

Serving 12+ industries across 50+ countries (83 countries as per publicly available information)

Chromium Chemicals –>

~85% revenues (FY21) , Leading manufacturer in India as well as South Asia,

FY21 Domestic: Export Sales Mix: 51:49 , 3 manufacturing units

Over the last few fears, the company has diversified its Chromium revenue profile with presence in both domestic and export markets. Earlier the portfolio was concentrated in chromium, domestic oriented and now diversified and balanced geographically in domestic and export markets

Applications –> Pharmaceuticals, Leather tanning, Pigments and Dyes, Plastic masterbatches, Ceramic glazes, tiles, Electroplating, Automotives, Refractories, Wood Preservative, Paper pulping and others.

Barium Chemicals –>

~15% revenues (FY21), Leading manufacturer in India, FY21 Domestic: Export Sales Mix: 45:55 ,1 manufacturing unit.

Applications –> Ceramics, tiles, glazes, bricks, refractories and water purification chemical in caustic soda industry, speciality glass, Luminescent Compounds, etc.

Strengths

Long standing relationships with domestic and overseas marquee customers.

Well diversified board with specialists in field

Certifications — ISO 9001:2015 , ISO 14001:2008, REACH Quality Certification

Income, EBITDA, PAT, PAT Margin improving

D/E is high but decreasing as desired

Ability to pass the rise in input prices and freight costs.

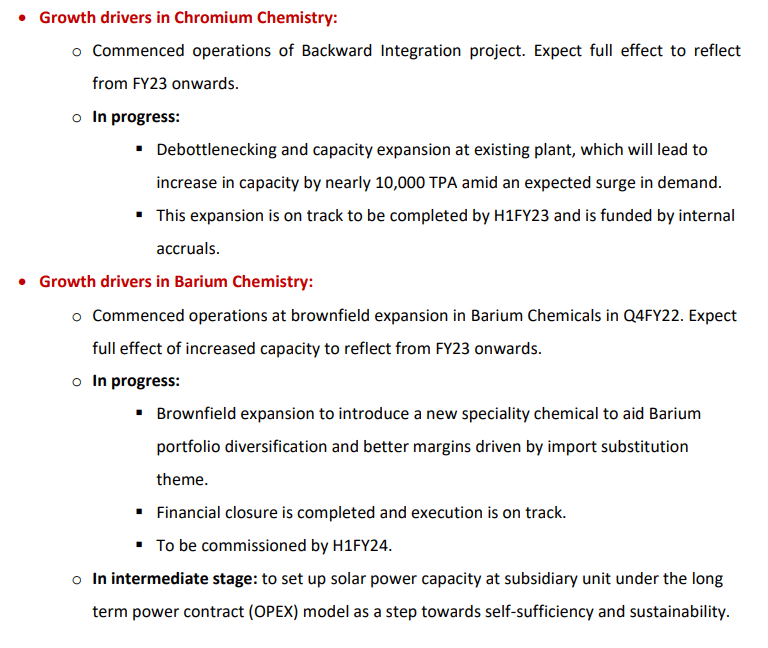

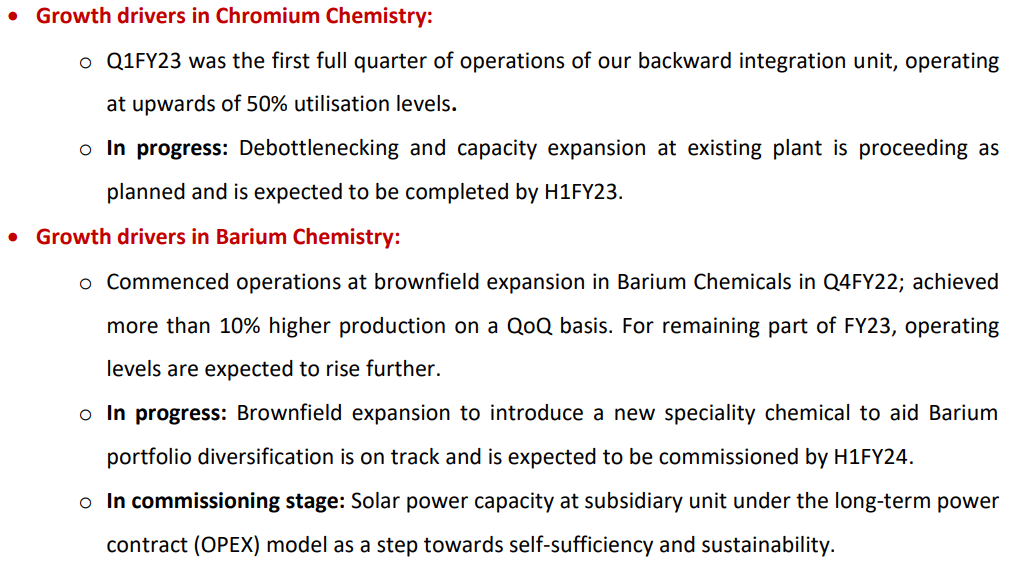

Triggers for company in coming quarters

Operating leverage: Most of the overheads or manpower addition are largely done considering FY21 as a base.

Higher utilizations from existing capacity: Major debottlenecking completed in Vizag unit in FY21 will lead to better throughput & efficiency

Majority of the capital expenditure towards sodium carbonate in Chromium chemicals is completed, Majority of company’s sodium carbonate’s current requirement will be met through the process. Significant cost reduction expected from upon being operational by Q4FY22E.

Focus is to increase market share with higher volumes in Barium chemicals

Leading manufacturer in India for Barium Chemical : Other players have less than 1/10th of Vishnu’s current capacity.

Incremental capacity of 20,000 TPA of Barium Carbonate expected to be operational by Q4FY22E

China plus 1 strategy has made them a preferred vendor instead of being a second option for their customers.

Exit Triggers

Crash in finished products prices or inability to pass on raw material in coming quarters

Any change in China +1 strategy for customers

Less than expected utilization of incremental capacity

Risks

Debt profile is still out of comfort zone

ROCE and PAT Margin still not as much as desired

Any Exports oriented issues including currency risk, freights costs

Significant promoter pledge of 40%

Any delay in operations of underway capacity expansion